The Sperry Van Ness® booth at the International Council of Shopping Centers (ICSC) annual real estate conference (RECon2013) was busy during the annual retail conference held every year in Las Vegas. We had over 80 of our advisors at the conference doing deals and getting the job done.

Randi Zuckerberg gave a great keynote (yes, she is the sister of Mark and the former marketing director for Facebook). Zuckerberg outlined the 10 trends that define the life of the modern consumers in mobile, social and tech. In case you missed it, I took copious notes and here is the summary:

1. Luxury on demand. Luxury is neither exclusive nor elusive. With sites like http://www.renttherunway.com/, anyone can borrow a red carpet outfit. In addition, we have personal assistants on demand and even corporate jets that we can rent.

2. Mobile everything and everywhere. Now we have cars and homes interacting with phones. We even pay for Starbucks with our phones. Other retailers need to follow.

3. Rise of “entre-ployees” creates challenges and more competition. Keeping good employees will remain difficult, as they will be in demand and looking to “do their own thing.” Companies who are doing well will try to create an entrepreneurial culture. They may even have entrepreneurs in residence. According to recent surveys, evangelist and community manager are two of the fastest growing titles. Retail can even take this a step further and not just empower their employees, but also empower consumers to be entrepreneurial. For example, consumers on Nike can design their own shoes.

4. Big data in the cloud. Big data sounds so off-putting, but it really is the key to personalization. Some examples of where folks can have personalized experiences are on Tripadvisor, or Netflix and Amazon as these sites make recommendations personal to you. Going forward, your local mall should know who you are when you arrive and be able to personalize the experience for you.

5. Fast, fun & easy retail. There’s been a huge increase of subscription shopping. In addition to Groupon, there are sites you have to join like Gilt, Hautelook and RueLaLa. Gilt takes it to a new level by giving Facebook fans early access to sales. Another change is that retail brands are becoming media companies. Mod Cloth adds product every day. Bonobos has a showroom order online.

6. Your car is the new phone. The latest apps (GPS, weather, music etc.) are being developed specifically for your car, and you can expect to see more.

7. The gamification of everything. Shopkick.com is one of several apps that give you bonuses and points for shopping.

8. Now everyone can have a second job online. If someone is looking for ways to make a little extra money online, they are not limited to affiliate marketing. Sites like Task Rabbit provide folks with time on their hands an opportunity to get paid to run errands and 99designs.com gives graphic designers a place to freelance.

9. Etiquette and digital detox. With all this digital and mobile developments, there is also a counterswing where folks are going to retreats looking for a digital detox.

10. Socially conscious retail. Consumers care about the backstory and with the web, they are able to find it.

What about the blue suede shoes? Approximately two weeks before the conference, while scrolling through Pinterest, I noticed a pair of shoes posted from a popular office fashion blog. The author raved about their comfort. This sparked my interest as anyone who has walked the Las Vegas Convention Center, you know it’s tough on your feet. I read all the online reviews, asked my friends on Facebook, and then decided to buy them.

So, I found the blue suede shoes by accident on a social network. I then crowdsourced opinions, and had a personalized shopping experience (as the store made other recommendations I might like). As for gamification – I’ve become the master of Googling for discounts and rebates and never paying full price–it’s like a game for me. There you have it:, a real life modern consumer in action at ICSC. The bonus? The shoes came in Sperry Van Ness® blue!

Diane K. Danielson is the Chief Platform Officer of Sperry Van Ness International Corp.

*All Sperry Van Ness® Offices are Independently Owned and Operated.

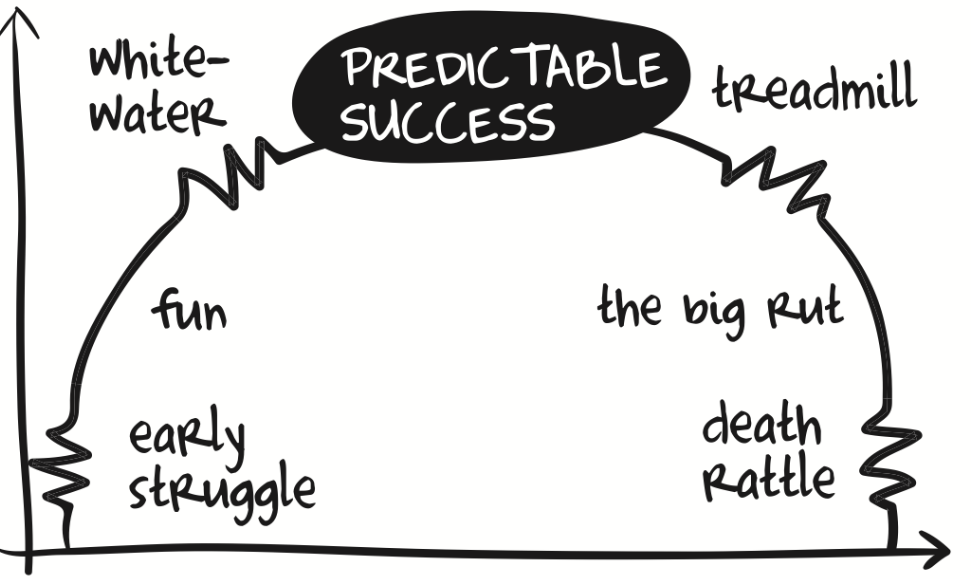

One of the hallmarks of the Sperry Van Ness® (SVN) brand is our

One of the hallmarks of the Sperry Van Ness® (SVN) brand is our