With a deep-rooted connection to the industry, it’s fair to say that CRE is in our new president’s blood. In this get-to-know-you article, Tim Spillane shares his perspective on the future of the industry and his plans to support the growth of our Managing Directors, Owners, and Advisors.

For Tim Spillane, newly appointed president of SVN, his career in commercial real estate has consistently revolved around prioritizing clients and helping them solve their occupancy portfolio challenges. Spillane’s motivation remains unwavering, even as the industry evolves.

“You know, I am a relationship first, transaction second kind of person,” he says. “I think for a lot of people in the real estate community, and especially the brokerage community, it’s all about the transaction. But it’s a small world, things come back to you, and no deal is ever simple. And it’s the relationship, however short or deep it is, that helps us get over the line in a deal.”

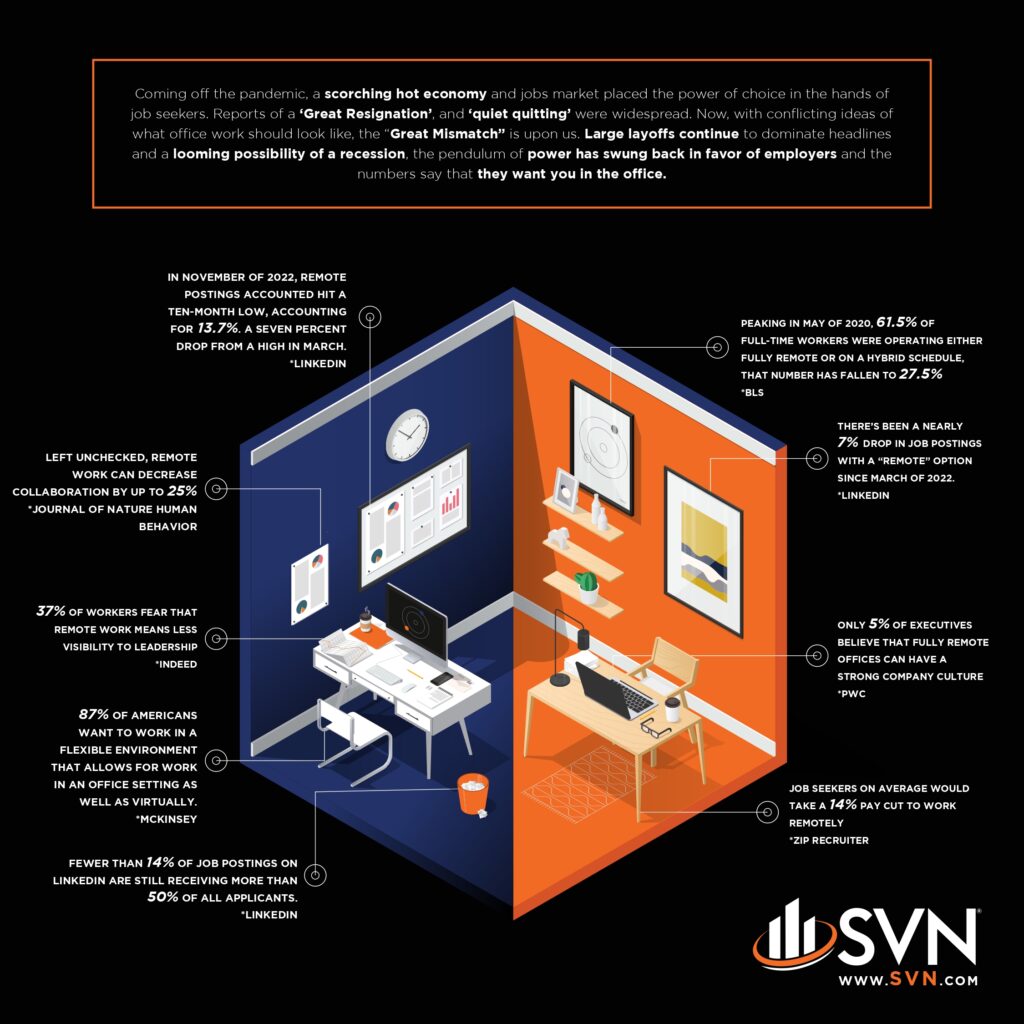

Today, he sees the changing role of the office as both a significant challenge and a promising opportunity for the commercial and corporate real estate industry.

The Evolving Landscape of the Industry

“During the pandemic, occupiers of commercial real estate accelerated their work-from-home plans and found out that their businesses could still function quite well,” Spillane says. “But as things progressed, companies in certain markets found themselves grappling with the delicate balance between remote work, office presence, maintaining their corporate culture, and driving business growth.”

Spillane explains that initially, there was a trend towards high-quality office spaces, enticing employees with amenities reminiscent of tech giants like Google. There was an abundance of Class A spaces with sought-after features to cater to this demand. Despite these efforts, office spaces remained underutilized, leaving sublet spaces available. However, Spillane notes that the industry is now witnessing a resurgence in occupancy, which bodes well for its future.

Culture and People: A Foundation for Success

It was the SVN culture that attracted Spillane to his new role at SVN. “SVN is founded on core values that align the success of the company with the success of the communities where we do business,” he says, adding, “This is really important to me. It’s the culture I come from, and it was the deal breaker for my next role. I’m here to understand what SVN is about, embrace that culture, and enhance it.”

Spillane expressed his admiration for companies and individuals who uphold their principles and prioritize doing what is right. “SVN has always stood out as a beacon of integrity, adhering to its principles and standing by them. I believe that SVN has made a profound positive impact within the real estate industry and among the clients it serves.”

Through his interactions with several SVN Managing Directors, Spillane recognizes and attributes the culture at SVN to a collective dedication to mutual support, collaboration, kindness, and generosity. This culture, he says, fosters a genuine sense of community and care within the SVN network.

Nurturing Growth and Collaboration: A Client-Centric Approach

Spillane sees his role as one where he works for SVN clients and colleagues. He adopts an inverted leadership approach, placing his employees and clients at the forefront of his focus. “I work for them,” he says. “This includes choosing the right owners to maintain the culture, selecting the right employees to continue what SVN is about, and then supporting them.”

Tapping into his almost three decades of experience in the CRE industry, Spillane will actively collaborate with SVN Owners and Advisors, serving as a trusted sounding board and helping them win business and grow their brokerages.

“These are folks that are driven to make a tangible impact and grow their own companies. They possess a competitive and optimistic spirit, and I can be a resource to help them achieve their goals,” he says.

Previously, Spillane spent 29 years at Jones Lang LaSalle, most recently leading its corporate accounts business in the Midwest US. In that time, he got to travel to more than 30 countries around the world. That means that today, in his downtime, you won’t find him at the golf course, but instead spending time with his family back home in the Chicago area.

States by

States by  “This is an important indicator of the continued growth of SVN – in cold hard results,” says SVNIC President and CEO Kevin Maggiacomo. “This top 10 ranking solidifies the strength of the SVN brand, the reliability of our many online CRE tools and the talent of our hardworking Advisors.”

“This is an important indicator of the continued growth of SVN – in cold hard results,” says SVNIC President and CEO Kevin Maggiacomo. “This top 10 ranking solidifies the strength of the SVN brand, the reliability of our many online CRE tools and the talent of our hardworking Advisors.” economists would describe this state of unemployment as near “full employment” as historical data analyses show that the country rarely dips below 4% and never for that long. Yet, this near historically low unemployment has occurred less from overly robust hiring, but instead from a lack of qualified workers able to fill open positions. In fact, the BLS reported in May a modest +138,000 jobs added to the economy, a good but not great number. Perhaps more importantly, the jobs report showed no single sector reporting significant losses, which indicates that all are hiring or holding steady. In addition, the only sector to have shown persistent losses over the last year, Mining (which includes energy production and exploration), has even reversed itself and is posting significant gains over the last few months. Therefore, the jobs report truly only supports the conclusion of an ever growing, albeit slowly, economy.

economists would describe this state of unemployment as near “full employment” as historical data analyses show that the country rarely dips below 4% and never for that long. Yet, this near historically low unemployment has occurred less from overly robust hiring, but instead from a lack of qualified workers able to fill open positions. In fact, the BLS reported in May a modest +138,000 jobs added to the economy, a good but not great number. Perhaps more importantly, the jobs report showed no single sector reporting significant losses, which indicates that all are hiring or holding steady. In addition, the only sector to have shown persistent losses over the last year, Mining (which includes energy production and exploration), has even reversed itself and is posting significant gains over the last few months. Therefore, the jobs report truly only supports the conclusion of an ever growing, albeit slowly, economy. macroeconomic cyclical activity. In the past, such low levels of unemployment were often followed by a mild recession within the same timeframe. However, recessions are typically triggered by excessive speculation, risk-taking, and usually hyper aggressive lending that pushes the economy too far. The data does not show any such excesses, especially in the use of leverage or aggressiveness of lenders. So, such predictions may not come true. Second, the labor shortage is being felt very strongly in the construction services and materials sectors. This means the cost to build new properties is rising faster than market rents and prices can justify. The net result is commercial real estate will probably hold its value just fine, and in fact, appreciate in areas where there is short supply. In conclusion, according to the data, we are probably closer to the middle of the cycle than the end.

macroeconomic cyclical activity. In the past, such low levels of unemployment were often followed by a mild recession within the same timeframe. However, recessions are typically triggered by excessive speculation, risk-taking, and usually hyper aggressive lending that pushes the economy too far. The data does not show any such excesses, especially in the use of leverage or aggressiveness of lenders. So, such predictions may not come true. Second, the labor shortage is being felt very strongly in the construction services and materials sectors. This means the cost to build new properties is rising faster than market rents and prices can justify. The net result is commercial real estate will probably hold its value just fine, and in fact, appreciate in areas where there is short supply. In conclusion, according to the data, we are probably closer to the middle of the cycle than the end.

2. Urbanization is happening across the country.

2. Urbanization is happening across the country. effect could be measured. Job growth has mostly sustained at robust, consistent levels as unemployment sits at near full employment at 4.7%. Of course, the biggest impact has been stock equity prices. The S&P 500 and Dow Jones Industrial Average have risen approximately 10% since the election as a result of anticipated future growth. This future growth in the economy and jobs, if it materializes, will also mean increased demand for all types of commercial real estate, resulting in a possible rise of rental rates and occupancies.

effect could be measured. Job growth has mostly sustained at robust, consistent levels as unemployment sits at near full employment at 4.7%. Of course, the biggest impact has been stock equity prices. The S&P 500 and Dow Jones Industrial Average have risen approximately 10% since the election as a result of anticipated future growth. This future growth in the economy and jobs, if it materializes, will also mean increased demand for all types of commercial real estate, resulting in a possible rise of rental rates and occupancies.