Commercial real estate markets have been generally growing in terms of pricing, rental rates, and occupancies since approximately 2011 and many market participants are beginning to openly wonder where the market is in the “cycle”.

Since the topic of market cycles can be somewhat misunderstood, we want to offer some clarification before presenting our assessment. Some investors believe that markets experience cycles based on some uniform period of time; such as every “X” years. In reality, markets, such as those for commercial real estate, move from peaks to valleys based on changes in supply and demand and any observation of timing is purely coincidental. An asset will see a “peak” and then decline when supply exceeds demand and this is when investors should look at changes in fundamentals to determine the relative risks and rewards of their investment due to cyclical forces.

CRE Markets Remain Healthy in Early 2017

With data available through the end of 2016, it is easy to see that most commercial real estate asset types are in the middle of the expansion phase of the real estate cycle. These are periods of long term growth in rents and declines in vacancy. According to REIS, all four major real estate classes experienced rent growth in 2016; 3.6% for apartment, 2.0% for retail, 2.4% for office and 2.2% for industrial. Office and industrial markets are experiencing the most absorption and improvements in occupancies and thus appear “earliest” in the expansion phase with year-end vacancy rates of 15.8% and 10% respectively. Retail vacancy rates remained flat at 9.9%, which given the number of “big box” closures, is actually impressive and masks the reality that many retail properties are actually experiencing rental rate growth and near full occupancies. The apartment sector, which began 2016 as the most watched sector given its 1.8% increase in supply, ended at 4.2% vacancy which is unchanged from 2015. Early 2017 data from Yardi Matrix shows modest rent growth has resumed which when considered with the rate of job creation, actually suggests that the apartment sector is not anywhere near as oversupplied as some have feared. However, relatively speaking, it is certainly the “latest” in the expansion phase. Overall, in early 2017 the fundamentals of commercial real estate markets still appear to be relatively healthy. In addition, given the current growth and optimism in the economy, they have room left to run in most situations.

2016 Transaction Volume is 3rd for Highest Recorded CRE Sales Activity

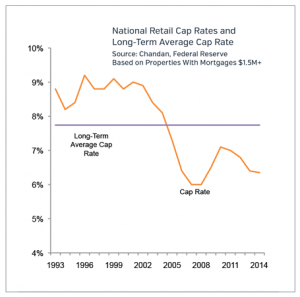

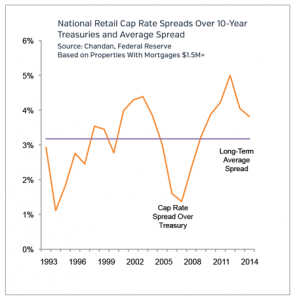

Prices of commercial real estate are a result of interactions between space markets (supply and demand) and the capital markets (competition for investment dollars). According to Moody’s and Real Capital Analytics, commercial real estate prices grew 9% in 2016 for another record breaking year. However, transaction volume was down 11% in 2016, but the year still ranks third after 2015 and 2007 for highest recorded commercial real estate sales activity. Overall, increases in interest rates and the 2016 decline in sales volume suggest the capital markets may put less pressure on price growth in 2017 than in recent years. The question of what cap rates will do given recent rate rises remains open but early evidence suggests that spreads are compressing and cap rates have shown minimal increases, however, this is still “too early” to call.

As of mid-February 2017, the commercial real estate markets appear to remain in expansion mode and 2016 was by all measures, a great year. If growth sustains, as the stock market is suggesting with its setting of new record highs every so often, fundamentals of commercial real estate should keep on moving upward as well. Census Bureau data showed that 2016 was a year for growth in construction spending; up 7.8% for nonresidential (commercial) and up 4.5% for residential (includes apartments). Therefore, there is more new supply coming but all the data suggests there is more than sufficient demand to keep the market in balance and growing.

2. Urbanization is happening across the country.

2. Urbanization is happening across the country. effect could be measured. Job growth has mostly sustained at robust, consistent levels as unemployment sits at near full employment at 4.7%. Of course, the biggest impact has been stock equity prices. The S&P 500 and Dow Jones Industrial Average have risen approximately 10% since the election as a result of anticipated future growth. This future growth in the economy and jobs, if it materializes, will also mean increased demand for all types of commercial real estate, resulting in a possible rise of rental rates and occupancies.

effect could be measured. Job growth has mostly sustained at robust, consistent levels as unemployment sits at near full employment at 4.7%. Of course, the biggest impact has been stock equity prices. The S&P 500 and Dow Jones Industrial Average have risen approximately 10% since the election as a result of anticipated future growth. This future growth in the economy and jobs, if it materializes, will also mean increased demand for all types of commercial real estate, resulting in a possible rise of rental rates and occupancies.

The drivers of the industrial sector’s headline performance numbers are varied. Breaking a pattern of decline that began in the 1980s, increasing manufacturing activity and employment since the end of the recession have supported the absorption of a wide range of heavy and light manufacturing spaces. That trend coincides with continued growth in shipping volumes, both on a large scale at the nation’s deep-water ports and along the “last mile” where fulfillment centers are allowing online retailers to shorten delivery times in major metropolitan areas.

The drivers of the industrial sector’s headline performance numbers are varied. Breaking a pattern of decline that began in the 1980s, increasing manufacturing activity and employment since the end of the recession have supported the absorption of a wide range of heavy and light manufacturing spaces. That trend coincides with continued growth in shipping volumes, both on a large scale at the nation’s deep-water ports and along the “last mile” where fulfillment centers are allowing online retailers to shorten delivery times in major metropolitan areas.

Never in the recent history of the American economy has it taken so long to recover the jobs lost over the course of a downturn. That milestone was reached in 2014, more than 6 years after the Great Recession first took hold. Employers added more than 3 million jobs over the year, finally recouping losses from the crisis-era cull in the strongest showing for job creation since the dot-com boom.

Never in the recent history of the American economy has it taken so long to recover the jobs lost over the course of a downturn. That milestone was reached in 2014, more than 6 years after the Great Recession first took hold. Employers added more than 3 million jobs over the year, finally recouping losses from the crisis-era cull in the strongest showing for job creation since the dot-com boom.

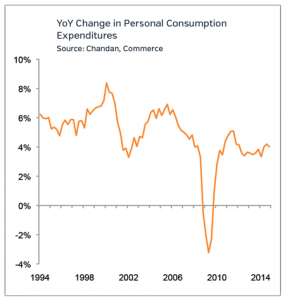

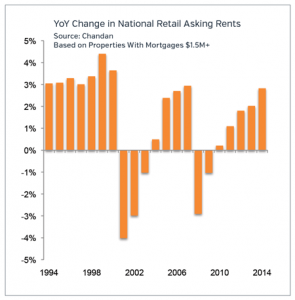

momentum in the sector’s otherwise prodding recovery. Over the next year, many of those investors will see their patience rewarded. A stronger consumer and a healthy uptick in lease signings, a dearth of new supply, and a growing appreciation for shoppers’ changing tastes are poised to lift occupancy rates and rents for well-located, well-tenanted, and well-managed properties. Risks remain, most clearly from shoppers’ substitution into online commerce for an ever-widening range of quickly delivered products. In managing those risks, the shift to destination “shop and play” retail models — and the emergence of new models including urban outlet centers — are taking on new urgency as competition for consumer dollars intensifies.

momentum in the sector’s otherwise prodding recovery. Over the next year, many of those investors will see their patience rewarded. A stronger consumer and a healthy uptick in lease signings, a dearth of new supply, and a growing appreciation for shoppers’ changing tastes are poised to lift occupancy rates and rents for well-located, well-tenanted, and well-managed properties. Risks remain, most clearly from shoppers’ substitution into online commerce for an ever-widening range of quickly delivered products. In managing those risks, the shift to destination “shop and play” retail models — and the emergence of new models including urban outlet centers — are taking on new urgency as competition for consumer dollars intensifies.

of their prospects in the job market, is also on the upswing.

of their prospects in the job market, is also on the upswing. early 2015.

early 2015.

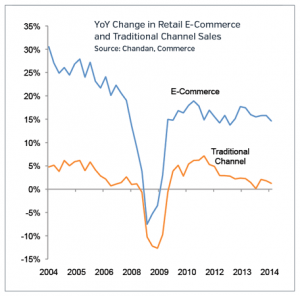

While the impact of e-commerce on retailers has varied dramatically across product types, there is no segment of the market that is fully immune to the fundamental changes in the way Americans shop. Properties that are perceived as more resilient to substitution out of brick-and-mortar, including the most urban locations and grocery- and pharmacy-anchored properties, commanded a larger price premium and lower cap rates in 2014. That divergence in retail property values may narrow in 2015 as a better job market and rising discretionary spending lift some weaker segments of the market.

While the impact of e-commerce on retailers has varied dramatically across product types, there is no segment of the market that is fully immune to the fundamental changes in the way Americans shop. Properties that are perceived as more resilient to substitution out of brick-and-mortar, including the most urban locations and grocery- and pharmacy-anchored properties, commanded a larger price premium and lower cap rates in 2014. That divergence in retail property values may narrow in 2015 as a better job market and rising discretionary spending lift some weaker segments of the market.

One of the mistakes I often see both new and seasoned investors make is to not properly define their investment parameters before getting started. This is important because it sets the course for the strategy and allows you to execute the plan more efficiently; and ultimately be more successful, because you have a baseline to which you can compare your investment portfolio.

One of the mistakes I often see both new and seasoned investors make is to not properly define their investment parameters before getting started. This is important because it sets the course for the strategy and allows you to execute the plan more efficiently; and ultimately be more successful, because you have a baseline to which you can compare your investment portfolio. Once you have defined investment parameters, the next step is to educate yourself. You need to study your respective market, in the particular product type niche or niches you have chosen. Research sale comparables and what properties are on the market for sale. This is where teaming with a trusted real estate advisor, like those at a Sperry Van Ness office, can greatly enhance the success of implementing your strategy. Picking a great commercial real estate advisor who specializes in the niche product type is critical to being able to quickly get up to speed and accomplish your goals (see our other post “

Once you have defined investment parameters, the next step is to educate yourself. You need to study your respective market, in the particular product type niche or niches you have chosen. Research sale comparables and what properties are on the market for sale. This is where teaming with a trusted real estate advisor, like those at a Sperry Van Ness office, can greatly enhance the success of implementing your strategy. Picking a great commercial real estate advisor who specializes in the niche product type is critical to being able to quickly get up to speed and accomplish your goals (see our other post “ Every commercial real estate deal needs to have an exit strategy. It’s important to think about this exit strategy early on; in fact, before the purchase is even made. Granted there will be times when the exit strategy will change, due to rising or falling market conditions, or supply and demand, and you will have to adjust your exit strategy. The main point here is that an exit strategy needs to contemplated in the beginning, not the end of a commercial real estate transaction. If you buy an office building at an 8% cap rate that is 70% occupied and your plan is to spruce it up, apply aggressive leasing tactics with a CRE advisor, and increase the revenues, only to find out later that the market for those types of investments are trading at 8.75% cap rates, due to the smaller tertiary market the property is in and the smaller, shorter term leases, then your exit strategy is flawed because the market will not pay you for the work you have done. Of course, this is a simplified example. The point is, have a defined strategy to exit the investment at the proper time, and always be willing and able to review your exit strategy and make adjustments. In the words of a favorite Kenny Rogers song, sometimes “you got to know when to hold ‘em and know when to fold ‘em, know when to walk away, know when to run!” Hope is NOT an exit strategy.

Every commercial real estate deal needs to have an exit strategy. It’s important to think about this exit strategy early on; in fact, before the purchase is even made. Granted there will be times when the exit strategy will change, due to rising or falling market conditions, or supply and demand, and you will have to adjust your exit strategy. The main point here is that an exit strategy needs to contemplated in the beginning, not the end of a commercial real estate transaction. If you buy an office building at an 8% cap rate that is 70% occupied and your plan is to spruce it up, apply aggressive leasing tactics with a CRE advisor, and increase the revenues, only to find out later that the market for those types of investments are trading at 8.75% cap rates, due to the smaller tertiary market the property is in and the smaller, shorter term leases, then your exit strategy is flawed because the market will not pay you for the work you have done. Of course, this is a simplified example. The point is, have a defined strategy to exit the investment at the proper time, and always be willing and able to review your exit strategy and make adjustments. In the words of a favorite Kenny Rogers song, sometimes “you got to know when to hold ‘em and know when to fold ‘em, know when to walk away, know when to run!” Hope is NOT an exit strategy. About Carlton Dean – Carlton has nearly 20 years of experience in the commercial real estate industry, with a special focus in the retail and multifamily sectors. Carlton is based in Tallahassee, Florida, but serves clients throughout the entire Southeastern US.

About Carlton Dean – Carlton has nearly 20 years of experience in the commercial real estate industry, with a special focus in the retail and multifamily sectors. Carlton is based in Tallahassee, Florida, but serves clients throughout the entire Southeastern US.

In addition to boasting some of the top tourist destinations in the United States, Central Florida has cultivated a thriving technology cluster in a 23-county region spanning the breadth of the state. Joint programs by regional universities and community colleges cover a wide range of technology fields, from microelectronics to biotechnology, modeling and robotics, aerospace, wireless technology and digital media. The growing workforce of highly skilled, young professionals is attracting tech employers and fostering startups, adding a significant and expanding source of well-paid residents to help drive retail sales. Tampa and Orlando share a similar overall retail vacancy rate of about 9.5 percent, but Tampa’s malls have outperformed with a vacancy rate below 4 percent and average mall rents of $25 or more per square foot. In Orlando, mall vacancy is 200 basis points higher and average rent is closer to $15. Tampa’s weak spot since the recession has been excess vacancy at strip and neighborhood centers, but falling rents in those subsets showed signs of flattening in late 2013. Orlando in particular has benefited from resurgent tourism that will increase as the economic recovery takes a firmer hold in U.S. markets this year. Investor confidence in Central Florida’s outlook has driven strong demand for net-leased retail since 2011, and would-be buyers are now showing greater interest in multi-tenant properties with below-market rents that offer good upside potential.

In addition to boasting some of the top tourist destinations in the United States, Central Florida has cultivated a thriving technology cluster in a 23-county region spanning the breadth of the state. Joint programs by regional universities and community colleges cover a wide range of technology fields, from microelectronics to biotechnology, modeling and robotics, aerospace, wireless technology and digital media. The growing workforce of highly skilled, young professionals is attracting tech employers and fostering startups, adding a significant and expanding source of well-paid residents to help drive retail sales. Tampa and Orlando share a similar overall retail vacancy rate of about 9.5 percent, but Tampa’s malls have outperformed with a vacancy rate below 4 percent and average mall rents of $25 or more per square foot. In Orlando, mall vacancy is 200 basis points higher and average rent is closer to $15. Tampa’s weak spot since the recession has been excess vacancy at strip and neighborhood centers, but falling rents in those subsets showed signs of flattening in late 2013. Orlando in particular has benefited from resurgent tourism that will increase as the economic recovery takes a firmer hold in U.S. markets this year. Investor confidence in Central Florida’s outlook has driven strong demand for net-leased retail since 2011, and would-be buyers are now showing greater interest in multi-tenant properties with below-market rents that offer good upside potential.

SVN Auction Services, a provider of date-specific sales and special asset solutions, has launched its popular and highly anticipated

SVN Auction Services, a provider of date-specific sales and special asset solutions, has launched its popular and highly anticipated  This year’s SVN Q4 event includes a wide variety of quality office, industrial, retail, land, hotels, multifamily, and NNN properties, including a historic hotel in Hot Springs, Arkansas, a fruit packing facility in Orange Cove, California, a former FedEx headquarters campus in Memphis, Tennessee, and a church and school in Oklahoma City, Oklahoma. Assets feature a $500,000 minimum value, up to a value range of $14,000,000.

This year’s SVN Q4 event includes a wide variety of quality office, industrial, retail, land, hotels, multifamily, and NNN properties, including a historic hotel in Hot Springs, Arkansas, a fruit packing facility in Orange Cove, California, a former FedEx headquarters campus in Memphis, Tennessee, and a church and school in Oklahoma City, Oklahoma. Assets feature a $500,000 minimum value, up to a value range of $14,000,000.

Let’s start this with a two question quiz:

Let’s start this with a two question quiz: Social media matters in commercial real estate in much the same way email and telephones matter. It’s a form of communication. Whether you use it or not, doesn’t stop others from doing so, which means you might be left out of some of the conversation. This may matter more or less, depending on where you are in your career.

Social media matters in commercial real estate in much the same way email and telephones matter. It’s a form of communication. Whether you use it or not, doesn’t stop others from doing so, which means you might be left out of some of the conversation. This may matter more or less, depending on where you are in your career.

Nearly 2 percent annual population growth and a diverse employment base are propelling San Antonio’s economy at a healthy clip, but the market lags the performance and rising profile of the other major Texas metros of Houston, Dallas/Fort Worth and Austin. San Antonio’s longstanding strength in the military and aerospace sectors, coupled with close proximity to Austin’s high tech cluster, has fostered an important cyber security sub sector. Located less than an hour’s drive south of Austin, the Alamo City has also captured a large piece of the Eagle Ford Shale energy boom emanating from South Texas, while its business-friendly climate, thriving tourism and manufacturing jobs attract new residents and fuel home sales. Office tenants were still giving back space in 2012 but absorption turned positive here in 2013. Delivery of several new office projects slowed rent growth and pushed the office vacancy rate into the middle teens last year without softening conditions enough to hamper rental rate growth. More construction is likely to begin in 2014. For investors who missed the opportunity to acquire office assets in Houston, Dallas or Austin at the bottom of the market cycle, San Antonio offers acquisition and development opportunities in a market that is in the early stages of appreciation.

Nearly 2 percent annual population growth and a diverse employment base are propelling San Antonio’s economy at a healthy clip, but the market lags the performance and rising profile of the other major Texas metros of Houston, Dallas/Fort Worth and Austin. San Antonio’s longstanding strength in the military and aerospace sectors, coupled with close proximity to Austin’s high tech cluster, has fostered an important cyber security sub sector. Located less than an hour’s drive south of Austin, the Alamo City has also captured a large piece of the Eagle Ford Shale energy boom emanating from South Texas, while its business-friendly climate, thriving tourism and manufacturing jobs attract new residents and fuel home sales. Office tenants were still giving back space in 2012 but absorption turned positive here in 2013. Delivery of several new office projects slowed rent growth and pushed the office vacancy rate into the middle teens last year without softening conditions enough to hamper rental rate growth. More construction is likely to begin in 2014. For investors who missed the opportunity to acquire office assets in Houston, Dallas or Austin at the bottom of the market cycle, San Antonio offers acquisition and development opportunities in a market that is in the early stages of appreciation.