Choosing the right multifamily real estate broker can make the difference between a profitable transaction and a costly mistake. Unlike single-family deals, multifamily properties involve complex valuations, existing tenant relationships, sophisticated financing structures, and nuanced market dynamics that require specialized expertise.

Whether you’re selling an apartment building or acquiring your next investment property, the broker you select becomes your strategic partner in navigating these complexities. The wrong choice can lead to underpriced listings, overpaid acquisitions, or deals that fall apart during due diligence.

Smart investors don’t leave broker selection to chance. Instead, they come prepared with targeted questions that reveal whether a broker truly understands multifamily markets and can deliver results. Before you sign a listing agreement or make an offer, here are the top questions to ask multifamily real estate brokers to make sure you’re working with the right partner.

Questions Sellers Should Ask Multifamily Real Estate Brokers

1. What’s your experience with multifamily properties in this market?

Specialization matters significantly in multifamily real estate. A broker who primarily handles office buildings or retail properties may lack the nuanced understanding of tenant dynamics, rent roll analysis, and multifamily-specific valuation methods that drive successful sales.

Ask for specific examples of recent multifamily transactions, including property types, unit counts, and deal complexities they’ve handled. Look for brokers who can speak confidently about local rental market trends, typical buyer profiles, and common challenges specific to your property type.

2. How do you determine property valuation?

Accurate valuation forms the foundation of any successful multifamily sale. Your broker should demonstrate a thorough understanding of multiple valuation approaches — income capitalization, comparable sales, and replacement cost methods.

They should be able to explain how they analyze rent rolls, factor in vacancy rates, and assess the impact of deferred maintenance or capital improvements on pricing. According to the National Association of Realtors, proper valuation requires understanding both current income streams and future income potential.

3. What’s your marketing strategy?

Marketing multifamily properties requires reaching the right buyer pool while maintaining operational confidentiality. Your broker should outline a comprehensive strategy that includes professional marketing materials, targeted outreach to qualified investors, and strategic use of both public and private marketing channels.

Ask about their network reach and how they identify potential buyers who are actively seeking properties like yours. The broader their qualified buyer network, the more competitive bidding you’re likely to generate.

At SVN, our Advisors combine national marketing reach with local market insight — leveraging syndicated listing platforms, targeted email campaigns, and direct broker-to-broker collaboration across our 200+ offices to maximize exposure for each property.

4. How do you handle confidentiality?

Maintaining tenant relationships and business stability during the sales process requires careful discretion. Your broker should have clear protocols for protecting sensitive information while still providing buyers with the due diligence materials they need. Inquire about their process for handling tenant communications, managing property showings, and controlling information flow to prevent unnecessary disruption to your operations.

5. What fees and commission structure do you use?

Transparency in compensation is key and helps you budget accurately and avoid surprises. Understand not just the commission rate, but also any additional fees for marketing, administrative services, or transaction management.

6. What’s your track record with deals like mine?

Past performance doesn’t guarantee future results, but it provides valuable insight into a broker’s capabilities. Request specific metrics: average days on market, percentage of list price achieved, and deal completion rates for similar properties.

Pay attention to how they’ve handled challenging situations — deals that required creative financing, properties with occupancy issues, or transactions that faced unexpected obstacles.

7. How do you screen buyers?

Qualified buyers save time and prevent deal failures. Strong multifamily real estate brokers pre-screen investors to confirm financial capacity before negotiations begin, including proof of funds, financing pre-approval, and investment experience.

Questions Buyers Should Ask Multifamily Real Estate Brokers

1. How well do you know this submarket?

Hyper-local knowledge separates good brokers from great ones. Your broker should demonstrate intimate familiarity with neighborhood rental rates, vacancy trends, tenant demographics, and upcoming developments that could impact property values. They should be able to discuss recent comparable sales, typical cap rate ranges, and market-specific factors that influence multifamily performance in your target area.

2. What’s your process for finding off-market opportunities?

In competitive markets, off-market deals often provide buyers with better pricing and fewer bidding wars. Ask about their relationships with property owners, other brokers, and industry contacts that generate exclusive opportunities. A well-connected broker should have systematic approaches for identifying properties before they hit the public market, giving you first access to the best deals.

3. How do you evaluate risks with a property?

Beyond the financials, brokers should help you spot potential red flags — deferred maintenance, zoning issues, or rising operating costs. Ask about their due diligence process and how they help buyers identify both obvious and hidden risks that could impact returns.

4. What cap rates are typical here right now?

This question tests both market knowledge and honesty. A knowledgeable broker should provide current cap rate ranges for different property types and quality levels, backed by recent transaction data.

Be wary of brokers who give vague answers or seem disconnected from current market realities. The Federal Reserve Economic Data provides a broader economic context that professional brokers should understand and reference when discussing local market conditions.

5. Can you connect me with lenders and other resources?

Multifamily transactions often require specialized financing, legal expertise, and professional services. Your broker should have established relationships with lenders who understand investment properties, attorneys experienced in multifamily transactions, and other professionals who can support your deal.

This network becomes particularly valuable when deals face tight timelines or unusual circumstances that require expert guidance.

6. What are common deal-breakers you see in multifamily sales?

Learning from others’ mistakes can save you time and money. Experienced brokers can share insights about common issues that cause deals to fail — whether it’s unrealistic seller expectations, buyer financing problems, or property condition surprises. This knowledge helps you avoid problematic situations and structure offers that are more likely to succeed.

7. How do you handle multiple-offer scenarios?

In competitive markets, multiple-offer situations are common. Your broker should have a clear strategy for positioning your offer competitively while protecting your interests. Ask about their approach to escalation clauses, non-price terms that can make offers more attractive, and how they gather intelligence about competing bids.

The Overarching Question

Regardless of whether you’re buying or selling, the most important question is: “How will you help me maximize returns and minimize risks?”

The best multifamily brokers don’t just facilitate transactions — they serve as strategic advisors who understand your investment objectives and work proactively to achieve them. They should be able to articulate specific strategies for optimizing your outcomes while protecting you from common pitfalls.

Look for brokers who demonstrate genuine expertise, maintain extensive professional networks, and show commitment to client success beyond just closing deals.

Making the Strategic Choice

Multifamily real estate transactions are too significant and complex to leave broker selection to chance. The questions outlined above help you identify professionals who truly understand multifamily markets and can deliver the expertise your investment deserves.

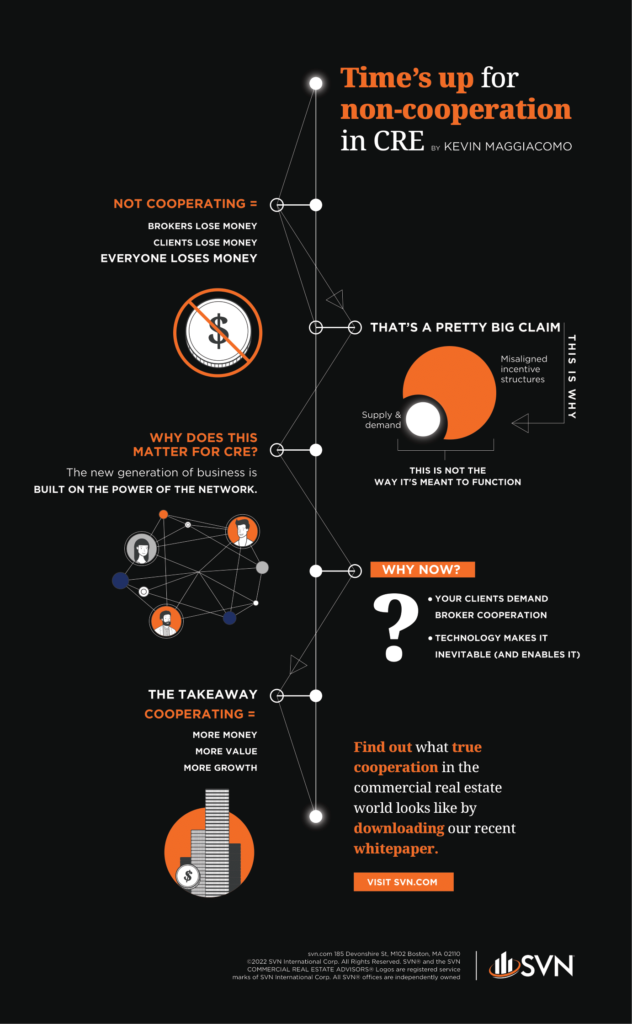

Remember that the best brokers often distinguish themselves not just through individual expertise, but through their access to collaborative networks that amplify market reach and deal flow. When evaluating potential partners, consider how their professional relationships and organizational resources can benefit your specific transaction goals.

Take time to ask these questions thoroughly. The right broker becomes a valuable long-term partner who can support your multifamily investment success for years to come. At SVN, our collaborative network of multifamily specialists combines local market expertise with national reach, ensuring our clients benefit from both deep market knowledge and extensive buyer-seller networks.

Contact our multifamily experts to discuss how our proven approach to multifamily transactions can help you achieve your investment objectives.