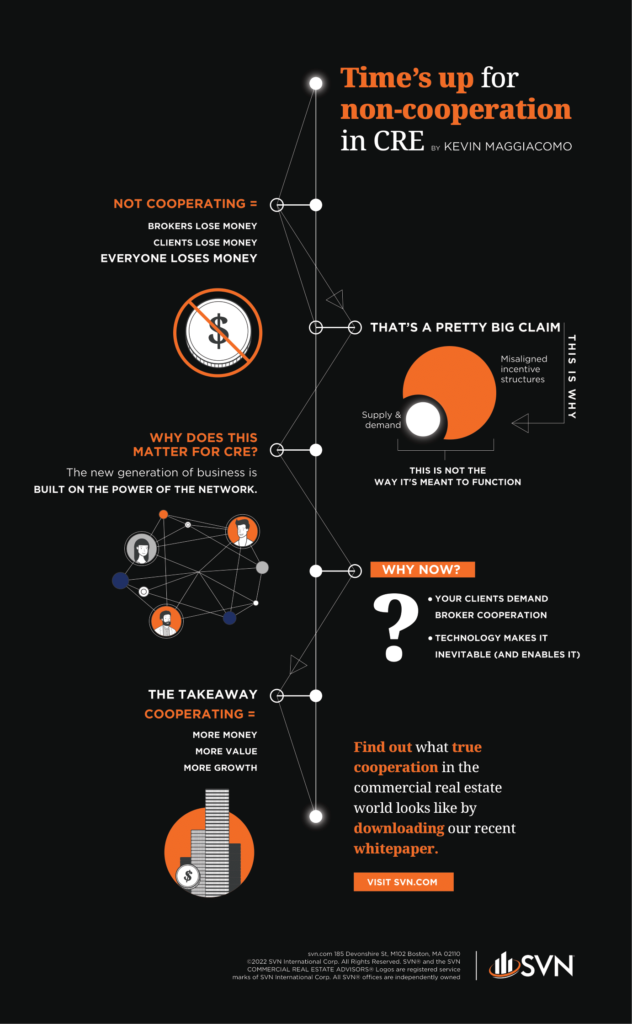

The clock is ticking on what is a systemic issue in commercial real estate investment sales: Non-cooperation and misaligned incentives create a loophole where brokers’ interests take precedence over sellers’ interests, resulting in an environment where most sellers are selling for less than fair market value. This model and way of doing business means that money is being left on the table by brokers and, more importantly, their clients.

In this white paper, we argue that:

• Today’s typical way of selling CRE assets is illogical and driven by misaligned incentive structures instead of sound economic principles

• The CRE industry urgently needs to embrace cooperation to drive shared value in the future

• Cooperating proactively with the brokerage community is the most effective way to increase demand for CRE assets on the market

Savvy brokers have the chance to embrace efficient, modern, and informed ways of working to achieve the best price and the best terms for their clients. We should know — SVN has been working like this for over 36 years.