With the global vaccine rollout now underway, there are plenty of reasons to be optimistic about an economic rebound ahead. As lockdowns end, restrictions lift, and new COVID-19 cases continue on a downswing trend, the commercial real estate industry can certainly expect some relief as we enter into the “Next-Normal.”

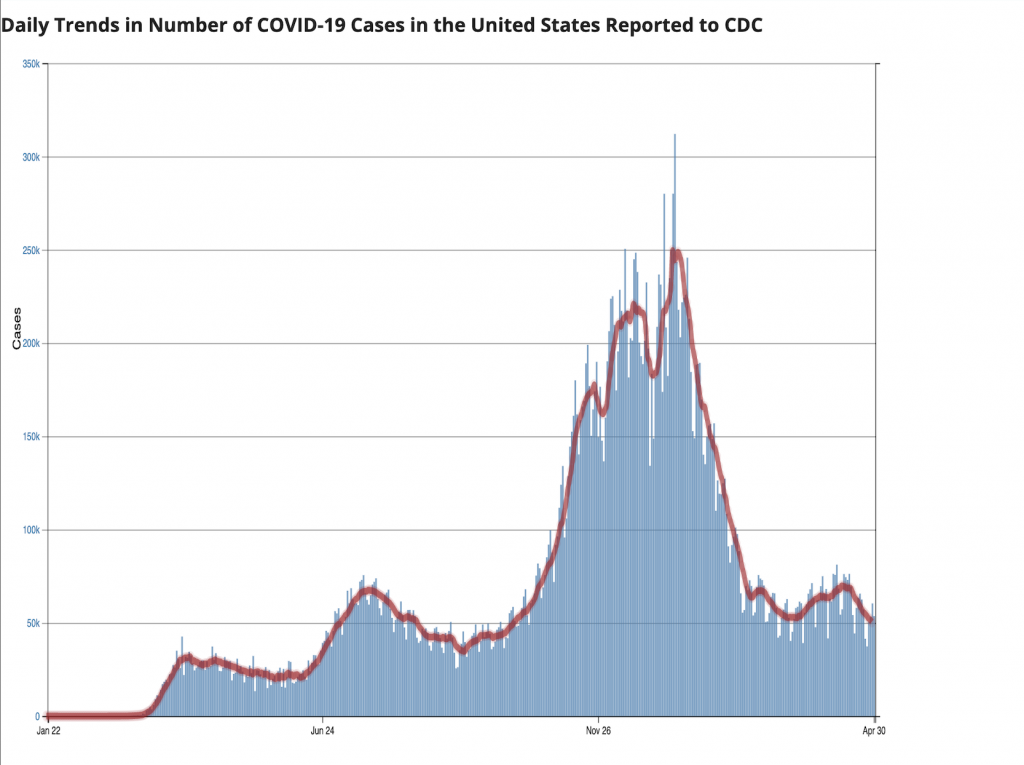

The CDC COVID Data Tracker (below) tracks daily trends in the number of COVID-19 cases in the U.S. as reported to the CDC by state and territory. As the below Data Tracker illustrates, the COVID-19 surge trend appears to be behind us.

While we aren’t completely out of the woods yet, things are looking up for industry recovery. And although we still have many unanswered questions, we also now have the forward momentum we lacked for so long, which allows for the big-picture planning needed for success in a post-pandemic world.

The global pandemic upended daily life for more than a year. It has changed how we live, where we work, even what we wear on our faces. As a result, we are seeing major shifts in consumer behavior, consumption, and lifestyle, among other things. Data collected during 2020 and currently in 2021 shows that several sectors of the commercial real industry are certainly still feeling the weight of these shifts.

Sectoral Impact

RETAIL

The Retail sector took a significant blow as the pandemic made nonessential in-person shopping quite literally illegal for a period. As Americans sheltered indoors, everyday activities such as going to the grocery store were now weighed under a contagion risk analysis. Consumption that would have normally been completed in-person has quickly flowed into online orders. The e-commerce share of retail consumption has steadily risen for more than two decades, reaching 11.8% in Q1 20201, but as the full effect of the lockdown reached a fever pitch in Q2, the share ballooned to 16.1%. While the share came down to 14.0% through Q4 2020, reflecting some natural reversion, the familiarity gained by consumers cannot be undone, and the pandemic has permanently accelerated some retail activity away from brick-and-mortar.

At the same time, manufacturers don’t have the same options they once did: As governments enacted state-wide lockdowns and shelter-in-place orders to limit the spread of COVID-19, manufacturers across the globe — which typically operate with long lead times — were brought to a complete halt. The manufacturing sub-sector has since been fighting an uphill battle, but as market conditions continue to improve, there is hope that factories will have the capacity to gain back some of the productions they lost in 2020.

INDUSTRIAL

For the Industrial sector, particularly warehouse spaces, there was a period in 2020 just ahead of the pandemic and the rapid shift to record levels of online shopping when rent growth for the overall Industrial sector was pacing ahead of cold storage. (A cold storage warehouse is used to store fresh and/or frozen perishable fruits or vegetables, or any combination thereof, at the desired temperature to maintain the quality of the product.) Cold storage rent growth has been rising since the start of the pandemic in 2020. Prior to the pandemic, rent for cold storage space averaged around $10 per square foot; currently, that number could vault to as much as $30 per square foot.2

As of February 2021, the Industrial sector has seen production drop by nearly 5%, compared to a year prior, while retail sales have increased by over 6%.3

HOSPITALITY

Hospitality was, and continues to be, among the hardest-hit industries during the pandemic. Some research suggests that recovery to pre-COVID-19 levels for the industry could take until 2023 or later. However, things already seem to be looking up for Hospitality: For the week ending March 13, 2021, U.S. hotel industry RevPAR was $53.45 — a decline of only 15.8% from the same week in 2020, which is mostly a function of easier comparisons, according to data from STR, CoStar’s hospitality analytics firm.4

Looking Ahead: The Road To Recovery

Economic recovery in a post-pandemic world depends on several factors. The economic impact of COVID-19 is being felt on a global scale, and with specific sectors more severely impacted, some may experience a quicker rebound than others once the crisis is behind us. Given the universal lifestyle changes people have had to make, and their subsequent effects on the economy, the COVID-19 crisis has pushed many industries to adjust rapidly… and continuously.

The recovery rate of various sectors will have a massive impact regionally over the next two years, according to a report by KPMG. And not all industries are equally affected: certain sectors of the economy will thrive once the pandemic is over, while others will face a seemingly endless headwind.

The Industrial sector seems poised for post-pandemic growth. A few sub-sectors are already beginning to see significant recovery:

- Warehouses underlying e-commerce, such as cold storage space

- Big-box retail selling essential goods, such as Walmart and Target

- Office space in certain locations, such as suburban areas

In the long run, the Retail sector is likely to be the biggest casualty as we exit the pandemic. This sector was already struggling before COVID-19, with vacant suburban shopping malls and big retailers shuttering stores across the country. Since the pandemic hit, many well-known brands have all filed for bankruptcy. The weakness of the retailers themselves, the accelerated growth of e-commerce, and questions about how quickly shoppers will head back to the stores all weigh against a strong recovery.

If the laws of physics extend to commercial real estate, then 2021 should be a year of recovery in the Retail sector, especially as restrictions on density are further relaxed and the resumption of normalcy gains steam. Notwithstanding the short-term recovery, Retail remains in a period of secular reorganization, and the sector remains open to disruption for the foreseeable future.5

Like so many industries, Hospitality will also see both subtle and substantial shifts in the post-pandemic era. Oxford Economics reports that gross domestic product grew by 9% in the first quarter of 2021, which has positive implications for the American travel industry. Jan Freitag, National Director for Hospitality Analytics at CoStar, reported that the March 2021 revenue per available room percentage change was “very positive” at 34%.6

We are still far off from “normal,” though an accelerating vaccination rollout brings the promise of a more rapid return to normalcy. As the economy recovers, leaders in the commercial real estate industry must begin to turn their attention to preparing for opportunities presented in the post-pandemic world.

Seizing Our Opportunity

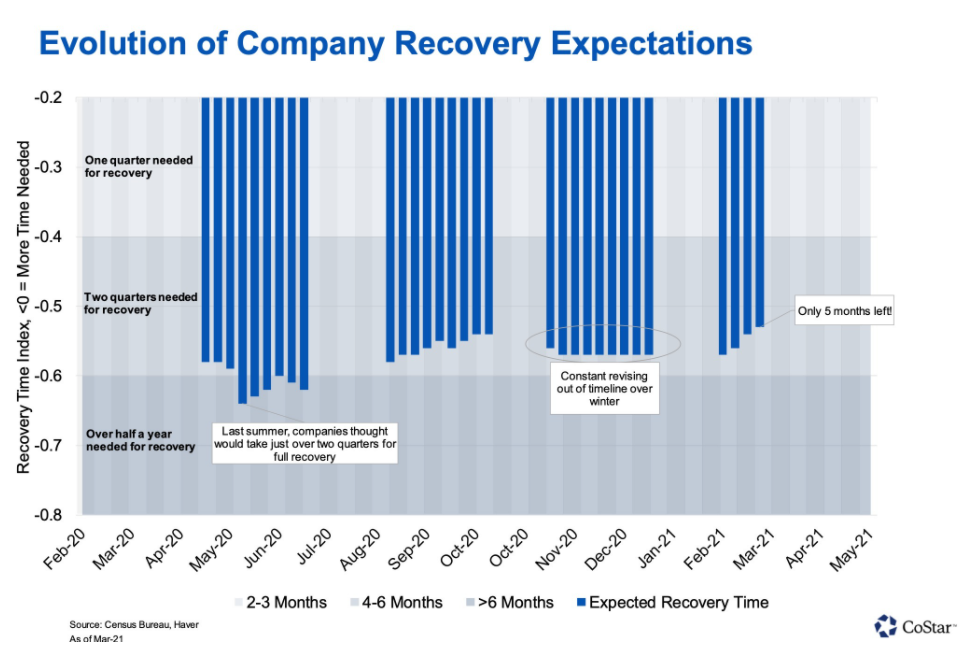

The Census Bureau’s Small Business Pulse Survey (SBPS) measures the effect of changing business conditions during the COVID-19 pandemic on our nation’s small businesses. According to the SBPS, companies are consistently marking up when they expect conditions to normalize. As leaders in the industry, we now have clear opportunities to re-strategize asset attribution and ultimately redefine what post-pandemic success means for commercial real estate.

Looking at history, other crises and external events show that generally, the CRE industry tends to lag the trajectory of the larger economy. But with the far-reaching effects of this pandemic, the CRE industry has felt the effects much earlier. In many ways, the pandemic has accelerated trends already occurring. While there is no specific answer or one-size-fits-all solution at this time, organizations that are able to move nimbly through the phases of recovery and embrace the “next normal” will thrive post-pandemic.

As the economy gains momentum, we will begin to see a split: organizations built to last, and those that are not. Those built to last, like SVN, are using this time to not only learn and emerge stronger, but also to prepare for and shape the future of commercial real estate.

Catalysts to Recovery: The SVN Difference

There are several components of SVN’s DNA working together to pull the future forward. For example:

- A strong and established brand, foundation, and community backing Advisors, attracting new talent and supporting local independent ownership

- Information & Fee Sharing: Every Monday, SVN Advisors present new and featured commercial real estate property listings on SVN | Live®. This live property broadcast is open to everyone in the industry.

- Product Council meetings and collaboration tools for all asset classes such as Industrial, Office, Self Storage, and Healthcare

- Online and scalable training to expand teams quickly, such as our SVN System for Growth courses and digital onboarding support

- Advanced digital recruiting tools, such as Mike Lipsey’s System for Success online training for Advisors

- Consultation support for asset attribution to establish team development

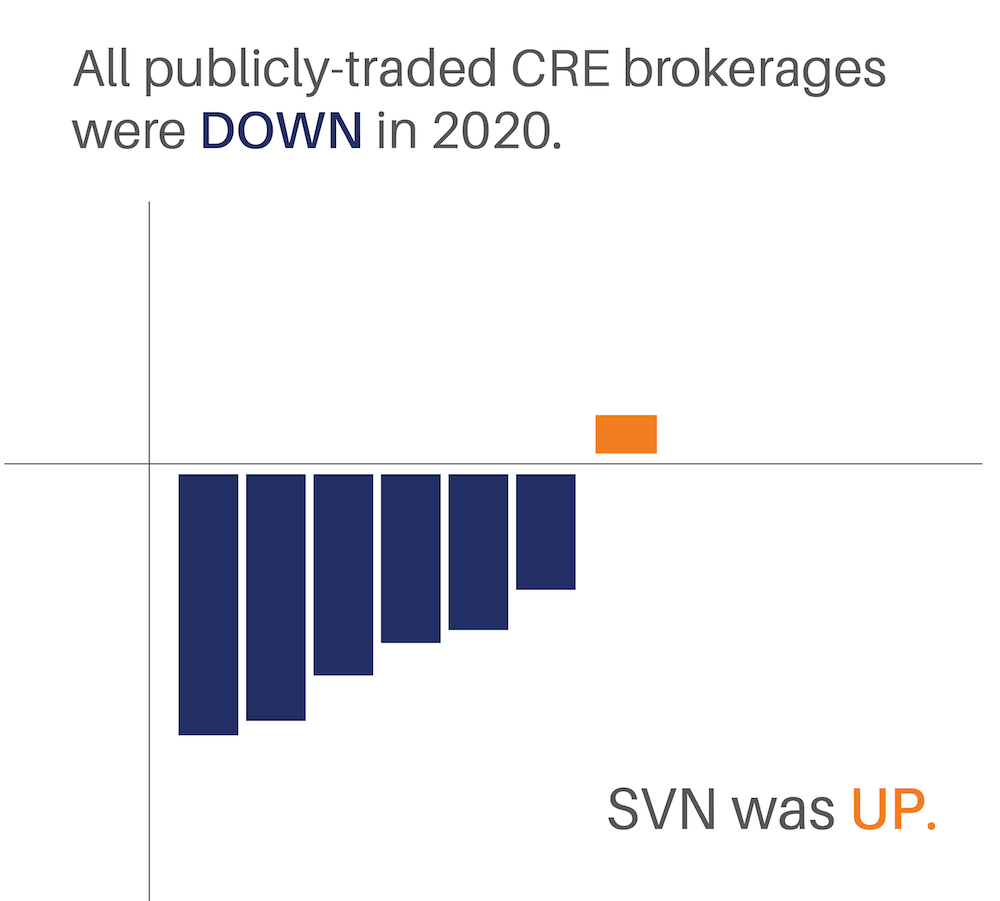

SVN was built to be future-proofed. That’s why, from 2019 through 2020, SVN’s gross commission income grew 3.1%… when everyone else was down. When all publicly traded CRE brokerages were up against double-digit declines — some facing 30% or more in lost revenue — SVN had its best year in company history. Models like SVN, which embrace automation, collaboration and cooperation, are uniquely positioned to take market share in this era of change, as client behaviors and expectations evolve.

The SVN brand offers something completely different from what any local, regional, or national firm is offering. This is the SVN Difference. And this difference is what ultimately creates 9.6% more value for our clients.

The Future Is Now

There is significant hope that 2021 will be a year of earnest recovery. As of the March WSJ Economic Forecasting Survey, on average, leading economists expect the US economy to grow by 6.0%. If reality ends up matching expectations, 2021 will mark the fastest annual growth since 1984.

SVN Advisors are leading the way into the “Next-Normal,” pulling the future forward, enacting change where and when it matters most.

The future is here. Are you ready?

Endnotes

- Census Bureau; through Q4 2020

- https://product.costar.com/home/news/19461

- https://product.costar.com/home/news/848506453

- https://product.costar.com/home/news/1802437521

- SVN Asset Class Report, Retail, 2021

- https://www.costar.com/article/1537124142/recovery-of-us-hotel-industry-is-firmly-underway

- https://product.costar.com/home/news/848506453